VAT Registration

VAT (Value Added Tax) registration is required for businesses that exceed a certain turnover threshold or engage in specific activities subject to VAT. The requirements for VAT registration can vary by country, but here are the general steps and documents typically needed for VAT registration:

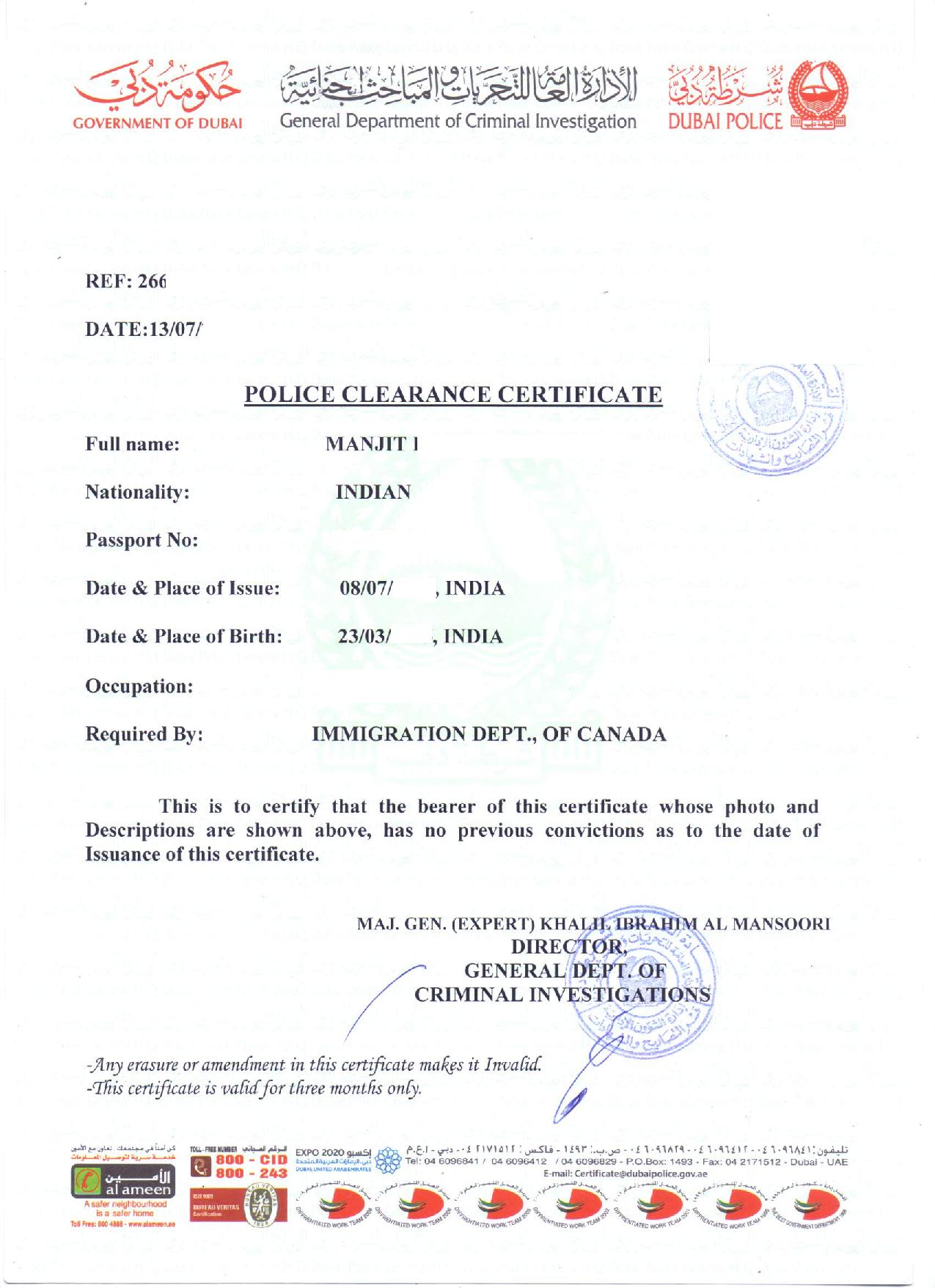

Overview of Police Clearance Certificate (PCC) in the UAE

A Police Clearance Certificate in the UAE serves as official proof that an individual has no criminal record during their stay in the country. It is often required for job applications, residency visa processes, and other legal requirements.

Eligibility

Expatriates:

Individuals who have lived or worked in the UAE.

UAE Nationals:

Citizens can also apply for a PCC.

General Requirements for VAT Registration

1. Eligibility Criteria:

Determine whether your business is required to register for VAT based on local laws. Common criteria include:

- Exceeding the annual turnover threshold.

- Engaging in specific taxable activities (e.g., selling goods or services subject to VAT).

- Importing goods or services.

2. Business Identification:

Provide basic information about your business, including:

- Business name.

- Business address.

- Type of business entity (e.g., sole proprietorship, partnership, corporation).

- Date of establishment.

3. Identification Documents:

Submit copies of identification documents for the business owner(s) or partners, which may include:

- National identification card or passport.

- Business registration certificate.

4. Financial Information:

Provide information about your business’s financial status, including:

- Estimated annual turnover.

- Bank account details.

- Accounting records.

5. Business Activities:

Describe the nature of your business activities, including the types of goods or services you offer. You may need to provide additional documentation or proof of these activities.

6. Tax Identification Number (TIN):

If applicable, provide your Tax Identification Number (TIN) or equivalent identifier issued by the tax authority.

7. Application Form:

Complete the VAT registration application form, which can usually be obtained from the relevant tax authority’s website or office.

8. Additional Documents:

Depending on the jurisdiction, you may be required to submit additional documentation, such as:

- Proof of business premises (e.g., lease agreement or utility bill).

- Partnership agreements (if applicable).

9. Submission:

Submit the completed application form and supporting documents to the relevant tax authority. This can often be done online or in person, depending on local regulations.

10. Registration Fee:

Be aware that some jurisdictions may charge a fee for processing the VAT registration application.

Additional Considerations

Time Frame:

The processing time for VAT registration can vary; it’s essential to check with the relevant tax authority for estimated timelines.

Thresholds:

Familiarize yourself with the specific turnover thresholds and regulations in your country, as these can change frequently.

Compliance:

Once registered, businesses must comply with VAT regulations, including collecting VAT from customers, filing periodic VAT returns, and maintaining proper records.

Deregistration:

Understand the conditions under which you may need to deregister for VAT, such as if your business falls below the threshold.

Conclusion

VAT registration is a critical step for businesses operating in many jurisdictions. Understanding the specific requirements and procedures in your area is essential for compliance and to avoid penalties. It may also be beneficial to consult with a tax professional or accountant to ensure that the registration process is completed correctly and efficiently.

Notarization

The document may first need to be notarized by a notary public in the country of issuance.

Foreign Affairs Ministry

Following notarization, it is usually required to get the document attested by the Ministry of Foreign Affairs (or equivalent) in the same country.

UAE Embassy/Consulate

The document then needs to be attested by the UAE Embassy or Consulate in the country of issuance.

Ministry of Foreign Affairs (MOFA)

Once in the UAE, the document must be attested by MOFA to ensure it is recognized within the UAE.

UAE Attestation

Ministry of Foreign Affairs (MOFA)

Once in the UAE, the document must be attested by MOFA to ensure it is recognized within the UAE.

Educational Documents

- Degree Certificate

- Diploma Certificate

- Bachelor Degree

- Master Degree

- Associate Degree

- Engineering Certificate

- Nursing Certificate

- Transcript Attestation

Personal Documents

Commercial Documents

- Memorandum of Association

- Article of Association

- Certificate of Incumbency

- Power of Attorney (POA)

- Commercial Invoices Attestation

- Certificate of Incorporation

- Certificate of Good Standing

- Board Resolution Attestation

Notarization Services

- Online POA

- Signature verification

- True Copy Attestation

- Embassy Attestation

- Mofa Attestation

- Company Documents

- MOJ Attestation

- Legal Translation

Why Choose Us?

25 Years of Experience

A solid reputation based on dependability and excellence.

Global Reach

Services provided across numerous nations.

Professional Advice

A committed group of experts assisting you at every step.

Tailored Solutions

Services specifically designed to satisfy your company formation and document attestation needs.